Passing the Texas insurance license exam is essential for becoming a licensed insurance agent. It covers key topics like insurance types, legal concepts, and state-specific rules, ensuring comprehensive knowledge. The exam requires a score of 70%, combining national and state sections. Preparation is crucial, and free study guides are available online to help candidates succeed. This guide provides a detailed overview of the exam structure, eligibility, and preparation strategies to help you achieve your licensing goals effectively.

1.1 Overview of the Exam

The Texas Insurance License Exam is a critical step to becoming an insurance agent in the state. It requires a score of 70% to pass, combining national and state-specific sections. The exam covers essential topics like insurance types, legal concepts, and underwriting principles. Using a free study guide PDF can aid in understanding the exam format and content, ensuring proper preparation for success.

1.2 Importance of Passing the Exam

Passing the Texas Insurance License Exam is vital for obtaining the necessary credentials to operate as an insurance professional. It ensures compliance with state regulations and demonstrates expertise in insurance principles. A free study guide PDF can significantly enhance preparation, covering key topics and strategies to help candidates achieve the required score and advance their careers in the insurance industry effectively.

Eligibility Requirements for the Texas Insurance License

To qualify, applicants must be at least 18 years old, a Texas resident, and pass a background check. The exam must also be passed within 180 days.

2.1 Age and Residency Requirements

To apply for a Texas insurance license, candidates must be at least 18 years old and maintain residency in the state. Residency status is verified during the application process, ensuring eligibility. Meeting these basic requirements is the first step toward obtaining the license, alongside passing the exam and completing a background check.

2.2 Background Check and Exam Completion

A background check is mandatory for Texas insurance license applicants, ensuring trustworthiness. The exam must be passed within 180 days of application. This step confirms both knowledge and character, essential for licensing. Applicants should ensure all legal requirements are met before proceeding with the licensing process to avoid delays.

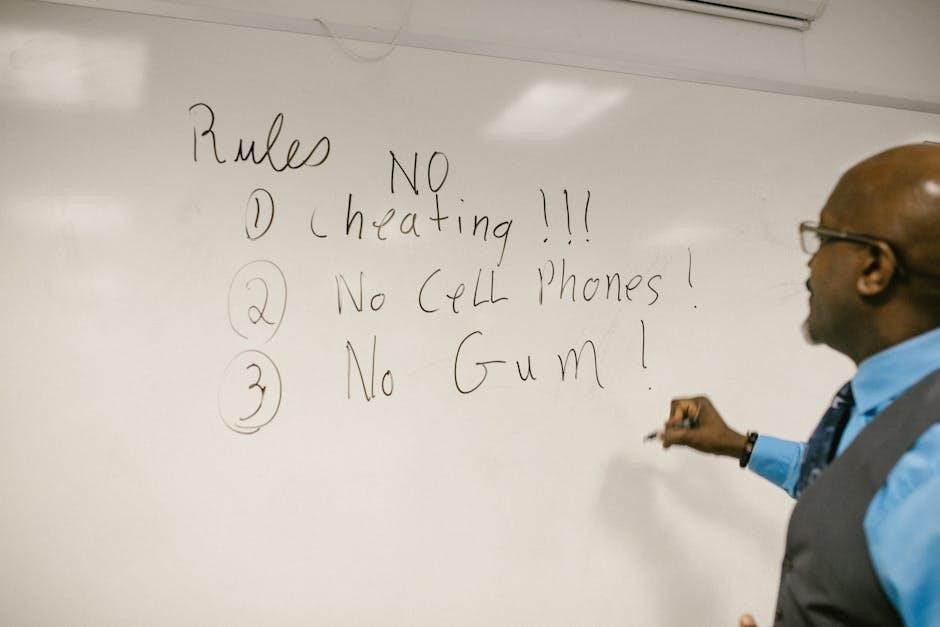

Structure of the Texas Insurance License Exam

The exam combines national insurance and state-specific rules, with mixed questions. A 70% score is required. Understanding both sections is crucial for success.

3.1 National Insurance Section

The national insurance section covers fundamental concepts like insurance types, legal principles, underwriting, and risk assessment. It tests knowledge of general insurance practices and terminology. Key topics include life, health, property, and casualty insurance, as well as ethical standards and contract law. This section is consistent across states and forms the core of insurance licensing exams nationwide.

3.2 State Rules Section

The state rules section focuses on Texas-specific insurance regulations, including licensing requirements, state laws, and administrative procedures. It covers topics like Texas Department of Insurance rules, state-specific policies, and legal standards. This section ensures candidates understand local insurance practices, compliance, and ethical guidelines unique to Texas, preparing them to operate effectively within the state’s regulatory framework.

3.4 Passing Score and Exam Format

To pass the Texas Insurance License Exam, you need a score of 70%. The exam consists of multiple-choice questions, with a time limit. The national and state-specific sections are combined. Understanding the format and content is crucial for preparation. Free study guides and practice exams can help master the material effectively.

Key Topics Covered in the Study Guide

The study guide covers insurance types, legal concepts, underwriting, and risk assessment, providing essential knowledge for the Texas Insurance License Exam. It ensures comprehensive preparation.

4.1 Insurance Types and Definitions

This section explains various insurance types, such as auto, home, life, and health, and defines key terms. It covers liability insurance, group life insurance, and annuities, providing clear examples to help understand each concept. The guide also outlines long-term care insurance and retirement plans, ensuring a solid foundation for exam preparation. Definitions are simplified for easy comprehension.

4.2 Legal Concepts and Underwriting

This section covers legal principles like insurable interest, subrogation, and the duty to defend. It explains underwriting processes, including risk assessment and policy issuance. Key topics include liability coverage, claims handling, and legal implications of policy terms. Real-world examples, such as supplementary payments and conversion privileges, illustrate how legal concepts apply in practical scenarios. Understanding these is vital for exam success.

4.3 Risk Assessment and Management

This section focuses on evaluating risks and strategies to mitigate them. It covers key concepts like risk classification, policy exclusions, and coverage limits. Topics include assessing factors such as location, driving records, and health history. Effective risk management techniques, including diversification and reinsurance, are also explored. Understanding these principles helps agents make informed decisions and protect clients’ interests while ensuring policy sustainability.

How to Prepare for the Texas Insurance Licensing Exam

Effective preparation involves creating a study schedule, focusing on weak areas, and utilizing online resources. Prioritize understanding core concepts and practice with realistic exam questions regularly to build confidence and accuracy.

5.1 Choosing the Right Study Materials

Selecting the right study materials is crucial for success. Opt for a comprehensive study guide aligned with the Test Content Outline (TCO). Utilize free PDF resources like Kaplan’s free samples or Quizlet flashcards for interactive learning. Ensure materials cover both national and state-specific content. Pair study manuals with online tools and practice exams to reinforce understanding and prepare effectively for the licensing exam.

5.2 Utilizing Flashcards and Online Resources

Flashcards and online resources are invaluable tools for efficient studying. Platforms like Quizlet offer free flashcards covering key terms and concepts, helping reinforce memory. Online resources such as Kaplan’s free samples and practice exams provide realistic test simulations, ensuring readiness. Utilize these tools to enhance understanding, track progress, and build confidence for the Texas insurance license exam. They complement traditional study guides effectively.

5.3 Test-Taking Strategies and Tips

Developing effective test-taking strategies is crucial for success. Start by skimming through all questions to identify easy ones first, ensuring you answer as many as possible. Use the process of elimination to narrow down choices and make educated guesses when unsure. Manage your time wisely, allocating 1-2 minutes per question. Practice with realistic simulations like Kaplan’s free samples to build exam readiness. Staying calm and reviewing answers before submitting can significantly improve performance.

Free Study Resources for the Texas Insurance Exam

Free PDF study guides and online flashcards are widely available, offering comprehensive exam prep. Kaplan provides sample materials, while Quizlet offers interactive flashcards for key terms and concepts.

6.1 Free PDF Study Guides

Free PDF study guides are readily available online, offering comprehensive preparation for the Texas insurance exam. Kaplan Financial Education provides sample materials, while other platforms offer detailed guides covering national and state-specific content. These resources are updated regularly to reflect current exam topics, ensuring candidates can study effectively without cost. Utilize these guides to master key concepts and ace your licensing exam confidently.

6.2 Online Flashcards and Practice Exams

Online flashcards and practice exams are excellent tools for active learning. Platforms like Quizlet offer comprehensive decks covering insurance types, legal concepts, and state-specific rules. Practice exams simulate real test conditions, helping identify weak areas. Kaplan Financial Education and other providers offer realistic questions and detailed explanations, ensuring thorough preparation for the Texas insurance licensing exam. Regular practice builds confidence and improves retention of key concepts effectively.

Steps to Obtain the Texas Insurance License

Obtaining a Texas insurance license involves scheduling and passing the exam, submitting an application, and completing a background check; After passing, apply for the license within 180 days.

7.1 Scheduling the Exam

Scheduling the Texas insurance license exam involves making a reservation and paying the fee online. Candidates can choose a convenient date and location. It’s essential to ensure all eligibility requirements are met before booking. After scheduling, focus on studying with approved materials or free guides to prepare effectively. Check availability and plan accordingly to secure your preferred time slot.

7.2 Submitting the License Application

After passing the exam, submit the Texas insurance license application online. Include required documents like proof of residency and background check results. Ensure all information is accurate and complete to avoid delays. Pay the application fee and review the submission for errors before finalizing. Once processed, the license will be issued, allowing you to work as a licensed insurance professional in Texas.

7.3 Completing the Licensing Process

After submitting your application and fees, the Texas Department of Insurance will review your submission. Once approved, your license will be issued. Ensure all requirements, including fingerprints and background checks, are finalized. Upon completion, you’ll receive your official insurance license, enabling you to legally practice as an insurance professional in Texas. Maintain your license through continuing education and renewal processes.

Practice Exams and Simulators

Practice exams and simulators are essential tools for exam preparation, helping candidates familiarize themselves with the format and content. They identify weak areas and improve test-taking strategies, ensuring confidence and readiness for the actual exam. Utilizing realistic questions enhances understanding and time management skills, making them a vital part of your study plan.

8.1 Benefits of Practice Exams

Practice exams offer numerous benefits, including familiarizing candidates with the exam format, identifying knowledge gaps, and improving time management skills. They provide realistic simulations, helping candidates understand the types of questions and content emphasis. Regular practice enhances confidence, reduces exam anxiety, and ensures a deeper understanding of insurance concepts. These tools are invaluable for bridging the gap between study materials and actual test conditions, ensuring better preparedness and performance.

8.2 Where to Find Realistic Practice Questions

Realistic practice questions for the Texas insurance license exam can be found through reputable platforms like Kaplan Financial Education, which offers free samples and practice exams. Quizlet provides flashcards and study sets specific to the exam. Additionally, websites like insuranceexamhelp.com offer free study guides and realistic practice questions to help candidates prepare effectively for the exam.

Maintaining Your Insurance License

Maintaining your Texas insurance license requires completing continuing education courses and renewing your license periodically. Stay updated on industry changes to keep your license active.

9.1 Continuing Education Requirements

To maintain your Texas insurance license, you must complete continuing education courses. These courses ensure you stay updated on industry changes and legal requirements. Typically, 24 hours of CE every two years are required, including ethics training. Use free study guides or resources like Kaplan Financial Education to fulfill these requirements and keep your license active and compliant with state regulations.

9.2 License Renewal Process

Renewing your Texas insurance license involves completing continuing education, submitting the renewal application, and paying the required fee. Ensure all CE requirements are met before applying. Fingerprints and a background check may be needed. Use the Texas Department of Insurance portal for online renewal. Stay updated on renewal deadlines to maintain your license without interruption. Proper documentation and timely submission are crucial for a smooth renewal process.

Additional Tips for Success

Create a structured study schedule and stick to it. Stay updated on insurance laws and regulations. Use flashcards for quick memorization. Highlight key terms in your study materials. Practice with realistic exams to build confidence. Regularly review and understand your weaknesses to improve. Consistency and dedication are key to achieving success.

10.1 Time Management and Study Schedules

Effective time management is crucial for exam success. Create a structured study schedule, allocating specific hours to each topic. Use calendars or planners to track progress. Break study sessions into manageable chunks with regular breaks. Prioritize difficult topics and review consistently. Utilize Kaplan’s study materials and online resources to stay organized. Consistency and dedication are key to mastering the exam content efficiently.

10.2 Staying Updated on Insurance Laws

Insurance laws and regulations frequently change, making it essential to stay informed. Regularly check updates from the Texas Department of Insurance and subscribe to industry newsletters. Utilize free study guides and online resources to review recent legal changes. Understanding current laws ensures compliance and prepares you for exam questions reflecting the latest regulatory updates, helping you avoid pitfalls and maintain professional competence in the field.